LEVI STRAUSS & (LEVI)·Q4 2025 Earnings Summary

Levi's Beats on Both Lines but Stock Drops 4% as Tariffs Squeeze Margins

January 28, 2026 · by Fintool AI Agent

Levi Strauss & Co. reported Q4 2025 results that beat Wall Street estimates on both revenue and earnings, but shares dropped ~4% in after-hours trading as tariff-driven margin compression overshadowed the operational wins. The company delivered 5% organic revenue growth and announced a new $200 million accelerated share repurchase program, signaling confidence in its DTC-first transformation.

Did Levi's Beat Q4 2025 Earnings?

Yes — Levi's beat on both revenue and EPS, extending its streak to five consecutive quarters of beating estimates.

The headline beats masked a tougher comparison: Q4 2024 benefited from a 53rd week that added ~$78M in revenue, making this quarter's +5% organic growth more impressive than the +1% reported figure suggests.

Why Did the Stock Drop Despite the Beat?

The ~4% after-hours decline reflects three concerns:

-

Margin compression from tariffs: Gross margin fell 100bps to 60.8% "primarily due to the impact of tariffs, partially offset by initial price increases." The company is operating under 30% tariffs on China imports and 20% on rest-of-world.

-

EPS down 16% YoY: Despite the beat vs. consensus, adjusted EPS of $0.41 was down from $0.49 in Q4 2024, driven by tariff costs and the loss of the extra week.

-

Guidance implies continued pressure: FY 2026 gross margin is expected to be "flat to prior year," suggesting tariffs will remain a headwind throughout the year.

How Did Each Segment Perform?

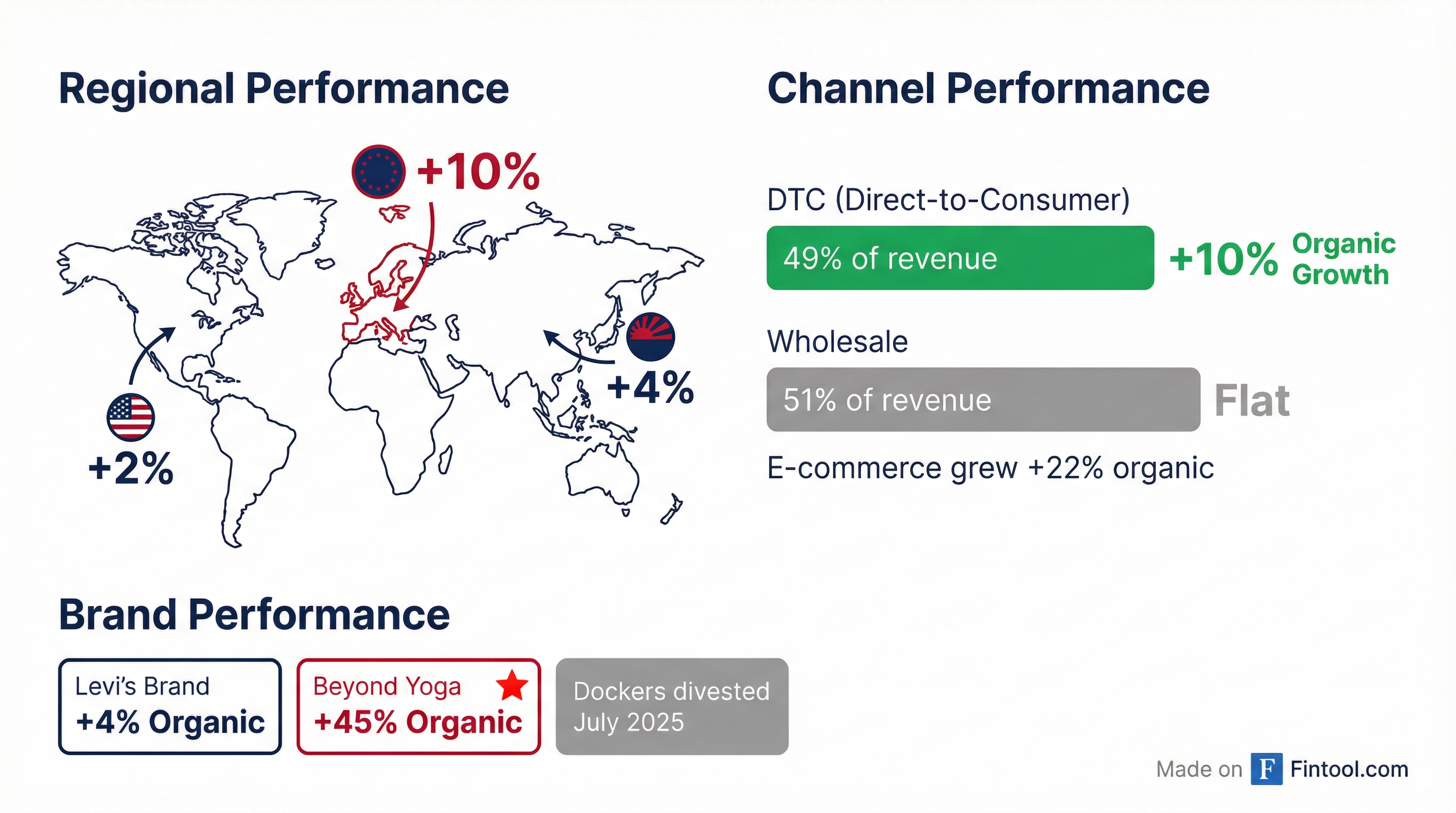

Geographic Performance (Organic Growth)

Europe was the standout with double-digit organic growth. The U.S. was flat on an organic basis after adjusting for the 53rd week impact.

Channel Performance

DTC now represents nearly half of total revenue, reflecting the company's strategic pivot. The business posted its 15th consecutive quarter of positive comps with high-single-digit comp growth. E-commerce surged 22% organically. Levi's opened 47 net new system stores in Q4, including mainline locations in Japan, India, Thailand, and Korea.

Holiday Performance

The November-December holiday period delivered 7% organic growth — the highest holiday revenue in at least a decade. CFO Singh noted the company "sold a lot of sweaters, more than we have sold in a long time" as the head-to-toe lifestyle strategy drove incremental purchases.

Category Performance

The Levi's brand holds more market share than the next two global competitors combined. In the US, the company now holds the #1 position in men's, women's, and the key youth demographic (18-30 year-olds) — the first time all three have held #1 simultaneously.

What Did Management Guide for FY 2026?

Key assumptions: U.S. tariffs on China at 30%, rest-of-world at 20%. The ~$0.04 EPS headwind from a higher tax rate is notable.

The guidance implies continued margin expansion toward the company's 15% adjusted EBIT margin target, but at a slower pace than some investors hoped.

Q1 2026 Guidance

The Q1 EBIT margin contraction is driven by Super Bowl marketing timing — production costs are expensed in Q1 but benefits extend through the year. Excluding A&P timing, adjusted EBIT margin would leverage in Q1.

What Changed From Last Quarter?

The deceleration in organic growth from 8% to 5% was expected given tougher comparisons. The margin compression was more pronounced due to tariff impacts hitting harder in Q4.

Full Year 2025 Highlights

The company returned $363 million to shareholders in FY 2025, up 26% from prior year, including $213M in dividends and $150M in share repurchases.

Capital Allocation Update

- New $200M ASR announced: To be completed within 3 months, no later than 6 months

- Dividend raised 7%: Continuing shareholder returns focus

- $363M returned in FY 2025: Up 26% vs prior year, highest annual buyback since IPO

- ROIC improved: ~16% return on invested capital

Strategic Initiatives

Super Bowl Marketing Push

Levi's will debut its first Super Bowl ad in over 20 years — hosted at Levi's Stadium — marking the launch of a new global campaign running through 2026. This explains the elevated Q1 marketing spend (+160bps vs prior year). The campaign will be supported by several World Cup games at Levi's Stadium this summer.

AI-Powered Transformation

Management highlighted several AI initiatives:

- Outfitting: AI-powered feature in the Levi's app that creates style looks using the full assortment and purchasing behavior

- AI Stylist Chatbot: Consumer-facing personalized recommendations launching this year

- Agentic AI Platform: Partnership with Microsoft to simplify and automate task-driven work, currently testing with employee rollout planned for 2026

Blue Tab Premium Collection

The premium Blue Tab collection rolled out globally in Q4, representing "the most premium expression" of the brand with elevated price points: $200-$350 for bottoms, $250-$400 for truckers. Management sees significant upside in the "largely untapped" premium category where Levi's is "significantly underpenetrated."

Supply Chain Improvements

The company has shortened end-to-end lead times from 16-17 months to 14 months, with tops moving to shorter cycle times and closer vendors. Globally directed product lines increased from ~20% in 2023 to 50% now, targeting 70-75%. SKU count reduction of 20-25% is ongoing.

Management Commentary

CEO Michelle Gass on the transformation:

"We've made deliberate strategic choices to maximize the potential of the Levi's brand, narrow our focus by exiting non-core businesses, and vigorously pursue our highest return growth opportunities. We are becoming a more consumer-focused, DTC-centric lifestyle company, which has led to faster growth and higher profitability."

On DTC margin opportunity:

"We absolutely believe that there's a lot of upside in DTC, both from a revenue standpoint and margin... As we continue to drive higher volumes, we'll clearly leverage off of the fixed costs in our store."

CFO Harmit Singh on gross margin outlook:

"Our view is the structural aspects that we're focused on growing — which is through mix, DTC, women's, and international — will resume the acceleration of gross margin in the years to come."

Q&A Highlights

On pricing power and tariff mitigation (Paul Lejuez, Citi): Management implemented pricing in Q4 2025 and again in January 2026, with more coming in February. "We have not seen any consumer or customer reaction to date, which I think is a testament to the strength of the business... we have pricing power, given how strong the brand is right now."

On DTC margin drivers (Jay Sole, UBS): CEO Gass outlined three drivers: (1) leverage on fixed costs as volumes grow, (2) retail excellence including enhanced lifestyle merchandising, and (3) a new global selling model rolling out worldwide. "The margin expansion that we saw this past year, we expect that to continue."

On Europe strength (Bob Drbul, BTIG): Europe delivered 10% organic growth with wholesale up 13%. Both UK and Germany posted double-digit growth. Operating margin expanded 380bps in Q4 and 180bps for the full year. Pre-book for 2026 is up mid-single digits.

On wholesale rationalization (Brooke Roach, Goldman): Management is rationalizing "non-strategic accounts" including the grocery channel in the US, which is pressuring Americas growth guidance. "I think it's a good thing for the brand, and again, we're driving to flat, even despite some of these account decisions."

On distribution center delays (Rick Patel, Raymond James): The US 3PL transition has taken longer than expected, with demand outstripping capacity. The company is running parallel operations which creates transitory costs through H1 2026. The Europe transition is complete and delivering top- and bottom-line benefits.

Balance Sheet Position

The 9% inventory increase bears watching but management attributed it to supporting growth initiatives.

Key Risks to Monitor

-

Tariff escalation: Current guidance assumes 30% China / 20% ROW tariffs hold. Any increase would pressure margins further.

-

Wholesale stabilization: Wholesale was flat organically after years of declines. Continued weakness would pressure the top line.

-

Consumer macro: Guidance assumes "no significant worsening of macro-economic pressures on the consumer."

-

Beyond Yoga integration: The +45% growth is impressive but the brand had goodwill impairment charges last year.

The Bottom Line

Levi's delivered a solid operational quarter with 5% organic growth, DTC momentum, and beats on both lines. However, the stock sold off on margin pressure from tariffs and a lower YoY earnings trajectory. The FY 2026 guide implies continued progress toward the 15% margin target, but the path is slower than bulls hoped. The new $200M buyback and dividend increase signal management's confidence, but investors appear focused on near-term margin headwinds. The transformation to a DTC-first model is progressing — the question is whether margins can expand meaningfully in a tariff environment.

Levi Strauss reports Q1 2026 earnings in April 2026.

Related Links: